St. Andrew’s Episcopal Church in Saratoga raised enough money to erase $2.32 million in medical debt throughout the Bay Area.

The Rev. Joel Martinez partnered with nonprofit organization Undue Medical Debt to organize the eight-week fundraiser. Undue Medical Debt was started by two former debt collectors to buy portfolios of medical debt and pay it off through money raised through local fundraisers. In 2016 the nonprofit, under its former name RIP Medical Debt, partnered with John Oliver of “Last Week Tonight” to erase $15 million worth of medical debt.

Related Articles

Instead of selling, some rural hospitals band together to survive

Lice pose no health threat, yet some parents push back on rules to allow affected kids in class

Corporate owner to close large Sebastopol drug recovery center

Kennedy’s panel recommends new restrictions on chicken pox, measles, mumps and rubella vaccines

Major California health insurers side with Newsom and medical groups to cover COVID shots

“This really was about all of us coming together and (doing) some good out in our community to live out our lives of faith in a different way than we had before,” Martinez said.

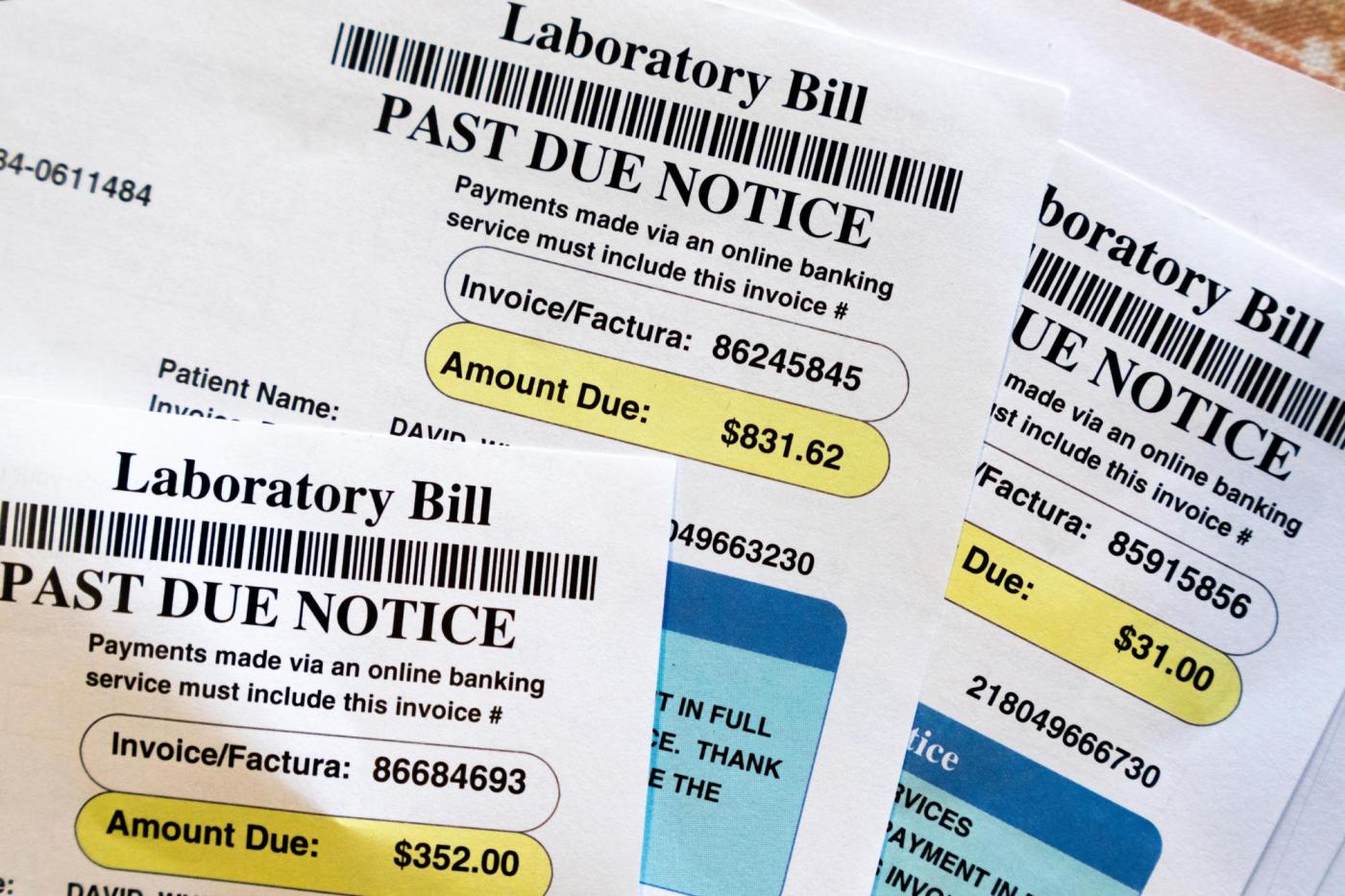

About 100 million Americans owe a total of $220 billion in medical debt, according to a Consumer Financial Protection Bureau report last October. Medical debt refers to unpaid medical bills or bills sent to collections as well as debt from using credit cards, payment plans, loans and other kinds of borrowing to pay for medical expenses. According to a May report by the UC Berkeley Labor Center, nearly four in 10 Californians reported having some kind of medical debt. Michelle Santoro, associate director of philanthropy with Undue Medical Debt, said the estimated median medical debt collection in California is about $1,964, and in Santa Clara County, it’s $1,729.

Medical debt disproportionately affects Black and Hispanic people and stems from lack of health insurance coverage.

“There have been cuts made at the federal level to coverage, specifically Medicaid, with the budget bill that was passed over the summer, which is something that we’re concerned about,” said Emily Brostek, public relations manager at Undue Medical Debt, about the federal government’s cuts to health care funding.

After seeing an article about the nonprofit working with an East Coast Episcopal church, Martinez brought it up to St. Andrew’s church director Maly Hughes. A group of church officials had been working on a project addressing disparities, including those in healthcare, so they were interested in a related fundraiser at the local level.

“Medical debt is one of those issues that affects all of us,” Martinez said. “I know that Silicon Valley is a very affluent area, but there’s also stark poverty in our area, too, so we knew that there was an opportunity for us to do good in the area that we’re in.”

The fundraiser ran from the Sunday after Easter to June 30. Martinez hosted a sermon series with seven different preachers to talk to the congregation about what generosity meant to them, and the fundraiser was included in church announcements and weekly newsletter updates.

The church raised over $15,000 from attendees, with an average donation of $200, according to Martinez. Undue Medical Debt then used this money to buy portfolios from debt collectors. Santoro said that every dollar raised could eliminate $100 of medical debt based on the negotiating price the nonprofit offers when it purchases the debt. The money St. Andrew’s raised cleared about $2.32 million worth of medical debt throughout seven counties in the Bay Area.

In an email to this news organization, Santoro said that over $1.22 million in medical debt was cleared in Santa Cruz County. In San Francisco County, that figure was just over $290,000; in Alameda County, it was over $213,000.

A little more than $197,000 worth of medical debt was paid down in Santa Clara County. In Solano, Contra Costa and San Mateo counties, those figures were just over $186,000, over $145,000 and a little over $68,000, respectively.

Undue Medical Debt chooses recipients of its debt buying program based on two eligibility requirements: they either must be making less than four times the federal poverty limit or have medical debt costing 5% or more of their annual income.

“The nice thing about it is that it’s not something they applied for. It’s an unexpected gift; it’s this idea of paying it forward,” Martinez said. “I’m excited for the people that are receiving this to be able to get the announcement that their debt has been waived, and for us to exceed the goal that we had set, it made my heart happy.”

Undue Medical Debt also drafts new policies to fix the healthcare system. They promote affordable, comprehensive and understandable health coverage, fair and simple medical billing practices and banning extraordinary collection actions and monitor medical debt through data collection. Brostek said that in light of the actions of the federal government, 15 states have passed legislation to protect people from medical debt and keep it off people’s credit reports.