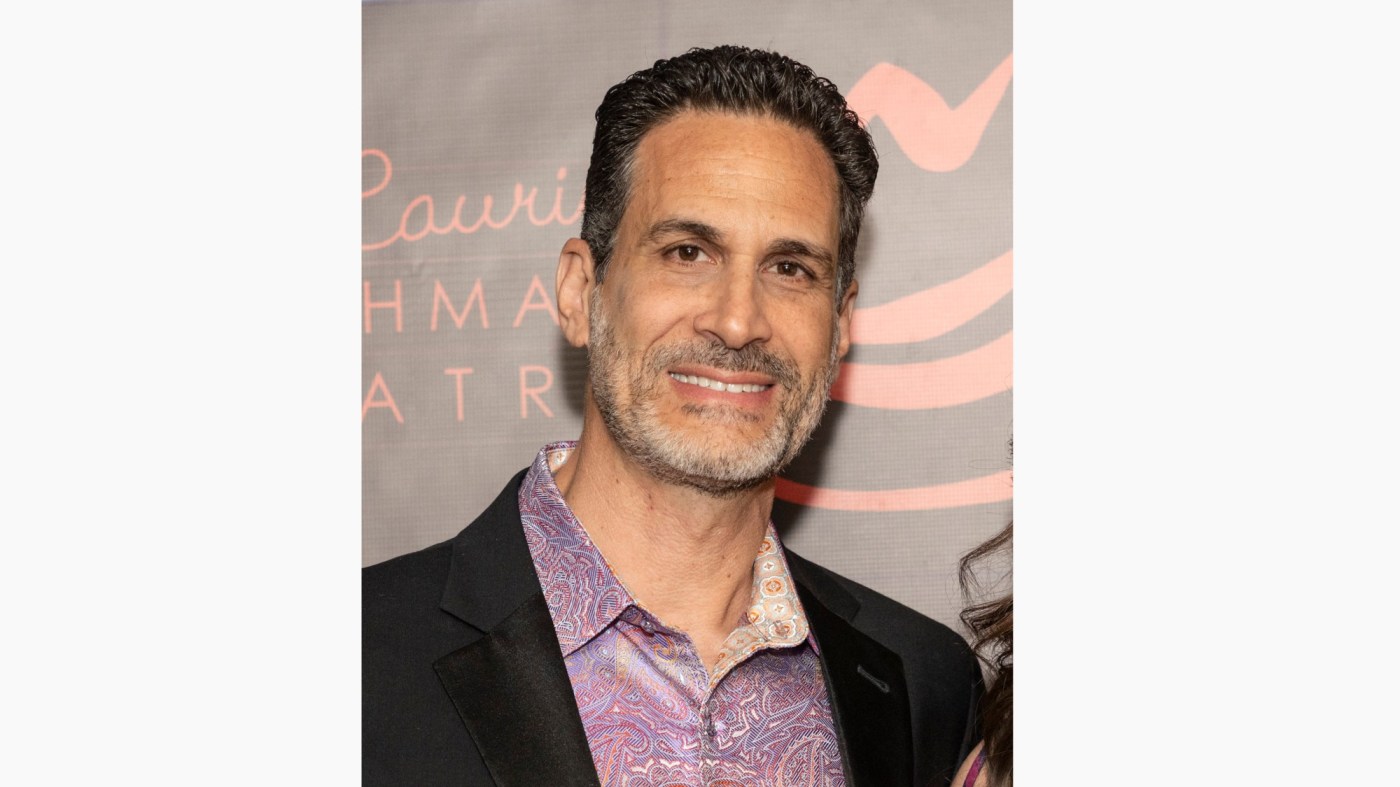

Marco Giovanni Santarelli billed himself as a “wealth creator.”

On podcasts and websites, Santarelli, 56, pitched his Laguna Niguel private equity firm, Norada Capital Management, which offered unsecured, high-yield promissory notes backed by investments in Broadway musicals, real estate and cryptocurrency.

But federal authorities allege it was all a scam, a Ponzi scheme that bilked some 500 clients nationwide of $62.5 million in investments — retirement money, family savings, nest eggs.

Related Articles

After a dog votes in 2 California elections, owner is charged with 5 felonies

They said it: Who’s in control of me?

Bay Area auto body shop owner gets jail time for fraudulent business dealings

2 California residents plead guilty in $16 million Apple warranty fraud scheme

$50 million suit against crypto ‘godfather’ reads like a movie plot, featuring corrupt California cops

Santarelli was charged Monday, Sept. 8, with one count of wire fraud and faces up to 20 years in prison if convicted, according to the U.S. Attorney’s Office in Los Angeles.

Investigators have seized more than $5 million connected to the scheme and are looking for more assets, said a news release.

According to the federal accusation, Santarelli solicited investors from June 2020 to June 2024 to invest in promissory notes ranging from $25,000 to $500,000. Santarelli was billed on the Internet Broadway Database as a producer, involved in such musicals as “The Who’s Tommy,” “Cabaret” and “A Beautiful Noise.”

Investors were promised monthly interest payments, around 12% to 15%, over three to seven years, authorities said. The money would come from investments in the musicals, real property, ecommerce and cryptocurrency, said the news release.

Santarelli gave balance sheets to investors listing the status of the assets, liabilities, and equity of Norada. Those sheets listed the total asset value of $143.3 million to $224 million.

However, Norada did not pay all the promised returns and interest payments. Instead, the fund invested in risky assets that were unprofitable, had very little return on investment, and carried a large amount of debt, said the news release. The balance sheets sent to investors hid more than $90 million in debt and included inflated assets. Santarelli skimmed from some investors to make interest payments to others, authorities said.

The investigation is continuing by Homeland Security Investigations and the FBI, and is being prosecuted by Chief Assistant United States Attorney Jennifer L. Waier.

Santarelli did not respond to an email seeking comment.

One victim, Glendale, Arizona, firefighter Gregg Lentz, said he found Norada through an ad on Facebook. He watched Santarelli’s podcasts and read the website testimonials. Lentz even talked to Santarelli by phone.

Lentz, 48, then invested $400,000, hoping to create generational wealth for his five children. “It was money I worked hard for,” he said.

For a while, the monthly interest payments came as promised, totaling $180,000, he said. Then the payments stopped.

Lentz said it took 25 years of hard work to build up that money. “Do I work another 25 years to get it back?”

He added that Saltarelli “ruined a lot of people’s lives. I’m glad to see some progress, because we’ve been living in limbo for 16-17 months.

Trista Yerkich, 44, of Dallas heard about Norada from a Honolulu investment counselor. She checked out the company and found that Santarelli appeared to have a good reputation.

Yerkich invested $200,000 in October 2023. By June 2024, the monthly interest payments had stopped and Norada gave her equity in the company instead — a company that she believed had no valuation.

“There’s no way he didn’t know he was going to pull this,” Yerkich said. “It will absolutely affect my retirement. … I have lost a lot of sleep and cried a lot of tears.”

She cheered the news Tuesday that Santarelli had been charged, but wondered if investors would ever be made whole.

“So many people have been impacted by this,” Yerkich said. “It’s a step in the right direction, but what does it mean in getting our money?”

Retired attorney Bill Keown, 71, of Florida sunk $700,000 that he earned by flipping houses. He, too, said he researched Santarelli and trusted him.

“Now I’m in a place I never thought I’d be,” Keown said. “When this happens, you beat yourself up … how can I be so stupid?”

Keown filed a lawsuit against Santarelli in September 2024 and received a default judgment for $750,000. He applauded the federal charge.

“It’s high time,” he said Tuesday. “Hundreds of other investors were all waiting on pins and needles for this to happen.”

Working with victims was Barry Minkow, convicted in the ZZZZ Best Ponzi scheme in 1987 and now a self-styled fraud investigator.

“For the dollar amount, the impact is deep and serious and crippling,” Minkow said.