Perhaps the best news for California’s ailing housing market is that mortgage problems remain below historical norms.

That’s what my trusty spreadsheet review found in bill-payment data for consumers from the Federal Reserve Bank of New York. The research is based on a sample of individuals with credit histories. The Fed examined debt levels and timely payments from 2003 to the second quarter of 2025 in 11 big states – including California – and nationwide.

Related Articles

Palo Alto residents push back on proposed El Camino Real apartment project

I lived in an RV. Don’t destroy the unhoused’s last remaining refuges.

Hidden in Big Beautiful Bill: A surprise boost to California’s affordable housing

CEQA rollbacks could pave the way for high-density housing in Los Gatos

Bay Area mobile home residents offer to buy property for $23.5 million

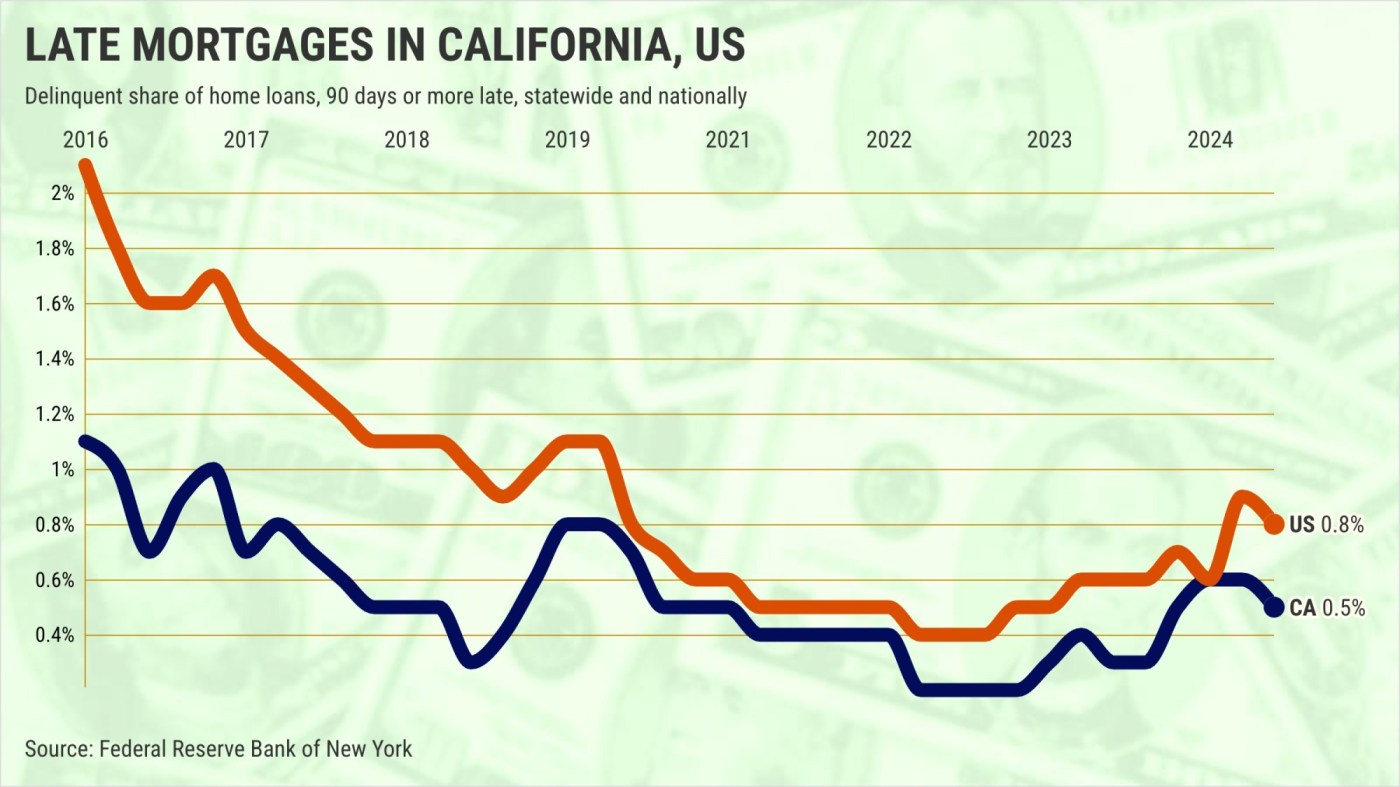

In the second quarter, 0.5% of all the dollars in California mortgages were 90 days late or more. That’s an improvement from the 0.6% share in the first quarter.

However, the latest reading is more than double the 0.2% rate at the late-payment bottom in 2023’s second quarter. That low came when consumers were flush with stimulus cash and bankers were generous with delinquent-loan assistance.

Even with the recent payment problems, though, California’s delinquent mortgages are far below the 2.8% average since 2003.

Plus, let me provide a reminder of how ugly things were in the bubble-bursting Great Recession. In 2009’s fourth quarter, this yardstick of skipped house payments hit 13.2% of all mortgages.

Similar tales

It’s hard to find serious house payment problems around the nation, too.

But let’s note that such struggles occur more frequently outside the Golden State. Nationwide, second-quarter delinquencies ran 0.8% of all mortgages, up from the 0.4% bottom in 2022’s third quarter.

Again, the U.S. is nowhere near historic problems. Late mortgages averaged 2.6% of dollars due since 2003, and peaked at 8.9% during the Great Recession.

And look at California’s key business rivals.

Texans were 90 days or more late on 0.8% of their mortgages last quarter. That’s up from the 0.2% recent bottom but below the 1.6% 21-year average and a 4.4% Great Recession top.

Now, a problem spot is Florida, where mortgage delinquencies hit 1.6%. That’s the highest since 2018’s fourth quarter and well above the recent low of 0.3%.

Still, the Sunshine State is below its 21-year average of 5.4% and a high of 20.6% during the crash era.

Expected bump

Your post-Great Recession housing anxieties are quite understandable.

Californians are well-advised to keep a sharp eye on troubled mortgages. Thankfully, payment headaches across the state – and the vast majority of the nation – seem tolerable at mid-year.

Recent upticks in mortgage troubles are somewhat expected. The pandemic-era lows for home-loan troubles were, in many ways, artificially concocted by generous help for distressed borrowers.

And oddly, the affordability headaches helped keep most house payments current.

Lofty home pricing certainly put lenders on edge about buyers’ creditworthiness. And those ridiculous costs mean that only well-financed house hunters are buying.

The newest woes

Ponder one early warning signal: The number of Californians entering foreclosure.

The second quarter’s new foreclosures equaled 13 for every 100,000 California borrowers. Yes, that’s up from the recent bottom of 2.

But look at the history books. Current foreclosure starts are below the average of 87 per 100,000 since 2003 and the 500 peak amid the Great Recession.

This yardstick also shows California with fewer problems than elsewhere.

Nationally, new foreclosures ran 18 per 100,000 in the second quarter, up from a recent low of 3 but below the 70 average or the record 240 after the housing bubble two decades ago.

Texas? New foreclosures ran 18 per 100,000 vs. a recent low of 2, an average of 54, and a Great Recession peak of 130. Florida was at 20 in the second quarter, compared with a low of 4, an average of 108, and a record high of 520.

Big balances

California is top-heavy in one debt category: the size of its home loans.

Look at mortgages owed on a per capita basis. That’s the dollars outstanding divided across all residents – owners, renters and their entire households.

Californians collectively owe $71,340 in mortgages, which is 56% above the typical American’s $45,820.

A Texan has $39,970 per capita in mortgages – 13% below the U.S. norm. In Florida, the average mortgage owed is $43,510, which is 5% below average.

Some normalcy

Curiously, Californians are somewhat normal when it comes to the amount owed for other borrowings such as auto loans, credit cards and student debts.

California has a total of $16,320 per capita in all other borrowings. That’s 5% below the $17,200 owed by the typical American.

Texas? $19,970 in other debts, 16% above the national norm. And Florida? $19,970, 16% higher than the nation.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]