Tenants in Southern California are not getting the same level of relief from rent increases as the average American.

Related Articles

1.4M of the nation’s poorest renters risk losing their homes with Trump’s proposed HUD time limit

Where in California do investors own the most houses?

Bay Area developer building ‘micro-studios,’ and yes, people are renting them

Could renting be part of the new American dream?

San Jose affordable apartment complex is bought for $60 million-plus

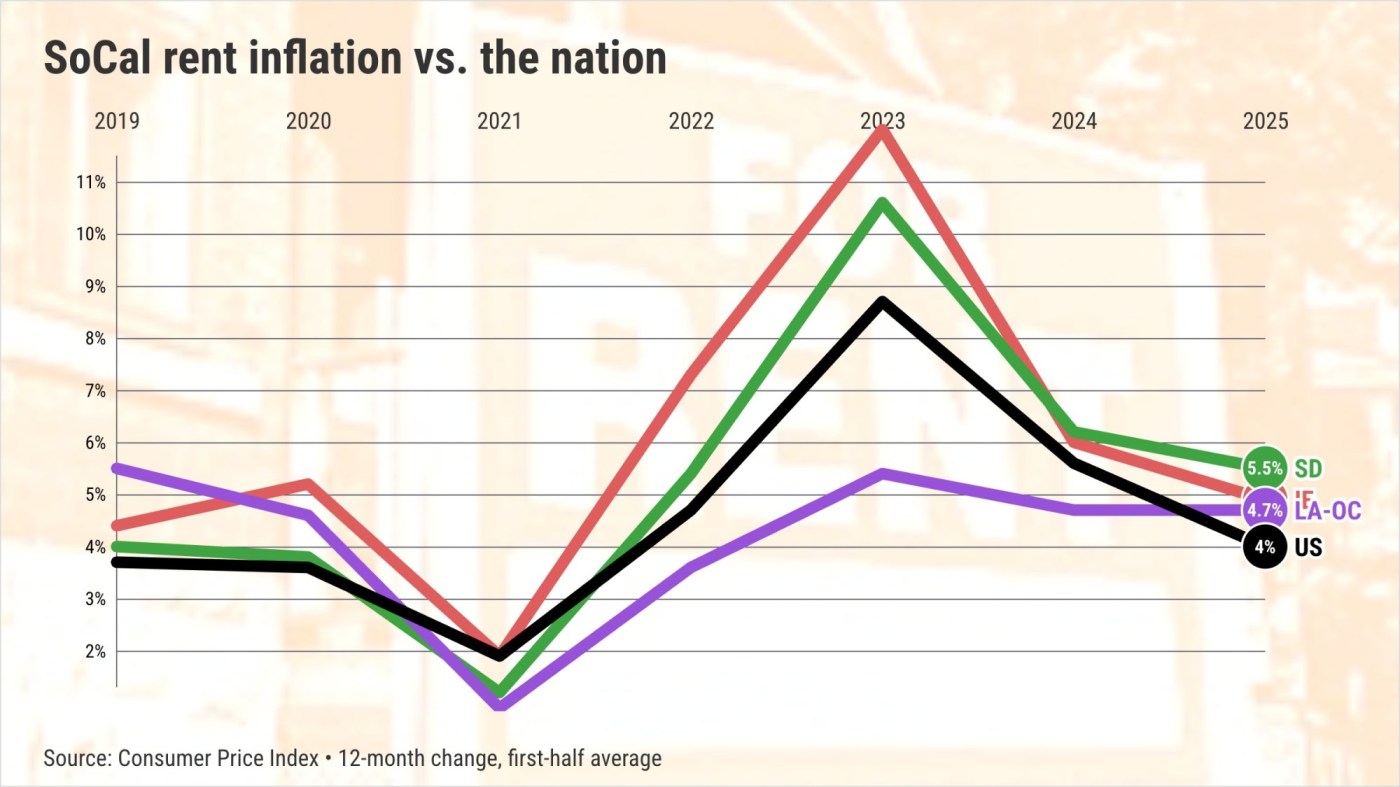

This insight comes from my trusty spreadsheet’s analysis of rent inflation data from the Consumer Price Index, which tracks 23 U.S. markets, including three in Southern California. The CPI’s rent trends are based on tenant surveys tracking payments for various types of housing. Most industry metrics focus on asking prices for empty units in large apartment complexes.

Looking at the first half of 2025, the CPI shows rent inflation nationwide running at a 4% annual rate, down from a 5.6% increase in the first six months of 2024. That’s an improvement of 1.6 percentage points.

Yet, nowhere in Southern California did tenants experience the same or even a lower rent increase or see a more significant year-over-year improvement.

In San Diego County, renters experienced a 5.5% increase over the past year, the second-largest nationally. Yes, this was a decrease from a 6.2% rise in the first half of 2024. Yet San Diego’s rent-hike drop of 0.7 percentage points was only the eighth smallest among the 23 markets.

Inland Empire tenants saw a 4.9% increase, ranking it the seventh largest nationally. This represented a reduction from the 6% increase in the first half of 2024. But the decline of 1.1 percentage points was just the tenth smallest.

And in Los Angeles and Orange counties, renters experienced a 4.7% rent inflation. This rise, the eighth-highest among the 23 markets, matched the increase of the first half of 2024. L.A.-O.C.’s steady rent hikes made it the fifth-worst trend for tenants.

Southern California’s rent hikes remain elevated because the region has not seen the same construction boom as other parts of the country. Those newer apartments have helped cap rent increases.

Additionally, there were the wildfires in Los Angeles in January, which destroyed over 12,000 properties. This led to more local residents seeking rentals, while decreasing the available supply.

Nothing new

Sadly, painful rent increases are not a new issue, either locally or nationwide.

Since 2019, rent in the Inland Empire has risen 43%, the fourth-largest increase among the 23 U.S. markets. And San Diego’s 37% rent inflation ranked sixth.

L.A.-O.C.’s 26% six-year increase, ranking 17th, was the only local market below the national pace. U.S. rent inflation was 32% since 2019, according to CPI calculations.

Nationwide extremes

Rent inflation: St. Louis was No. 1 for the first half at 5.9%. Phoenix was best for renters, off 0.7%.

One-year change: Honolulu renters enjoyed the biggest improvement – a drop of 7.7 percentage points to 3.4%. New York had the biggest increase, up 0.8 points to 5.3%.

Six-year increase: Tampa is No. 1, up 54%. Smallest was San Francisco, up 15%.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]