By Eliyahu Kamisher and Mark Chediak, Bloomberg

California Governor Gavin Newsom is circulating a legislative proposal to shore up a state fund for utilities that’s at risk of being depleted following the deadly wildfires that struck Los Angeles County in January.

The plan would channel an additional $18 billion to the wildfire fund, almost doubling the current commitments, said people familiar with the matter. Electricity ratepayers would contribute half the money through a monthly fee while the other half would come from three utility companies that benefit from the fund, Edison International, PG&E Corp. and Sempra, the people said.

Related Articles

Value of homes impacted by California wildfire totaled almost $52 billion

Berkeley’s new accessory dwelling unit policy aims for balance

Mercury to seek new home insurance rates using California’s risk modeling system

California’s property insurance apocalypse: Some progress, no immediate relief

Opinion: Inmate firefighters risk their lives saving California. They deserve better pay.

Newsom’s proposal is emerging as a potential lifeline for the utilities amid uncertainty over liability linked to the Los Angeles fires. Investors dumped Edison shares amid worries that the company would be found liable for one of the blazes, potentially draining the fund and leaving utilities without a cushion if another disastrous fire hits the state.

“We continue to work with the legislature on policy that will stabilize California’s Wildfire Fund to support the recovery of wildfire survivors and to protect California utility consumers — even as wildfires become bigger and more destructive due to climate change,” Newsom’s office said in a statement.

The proposal is still in draft form and could be subject to change, said the people, who asked not to be named because the discussions are private.

The California Wildfire Fund was established in 2019 after liabilities drove PG&E into bankruptcy. State lawmakers created the $21 billion fund to help stabilize utilities’ finances and limit shareholder losses. The state’s investor-owned utilities can tap into the fund to cover fire-related damages exceeding $1 billion. The fund currently has more than $13 billion in assets, according to the state.

While no cause of the Los Angeles fires has been determined, victims have filed multiple lawsuits against Edison, alleging that its equipment started the Eaton fire, one of the conflagrations. With insured losses from that blaze estimated to be as much as $23 billion, claims from it risk exhausting the wildfire fund if Edison is found to be responsible.

Shares of Edison, which operates the region’s largest utility in Southern California Edison, have tumbled more than 30% since January. The potential draining of the fund has also triggered a selloff of PG&E shares, even though the company isn’t connected to the Los Angeles-area blazes.

Southern California Edison spokesperson David Eisenhauer said the utility looks forward to working with the governor or legislators on any proposals.

PG&E declined to comment. Sempra’s SDG&E utility didn’t immediately respond to a request seeking comment.

Edison rose 1.5% in after-market trading. PG&E climbed 3%.

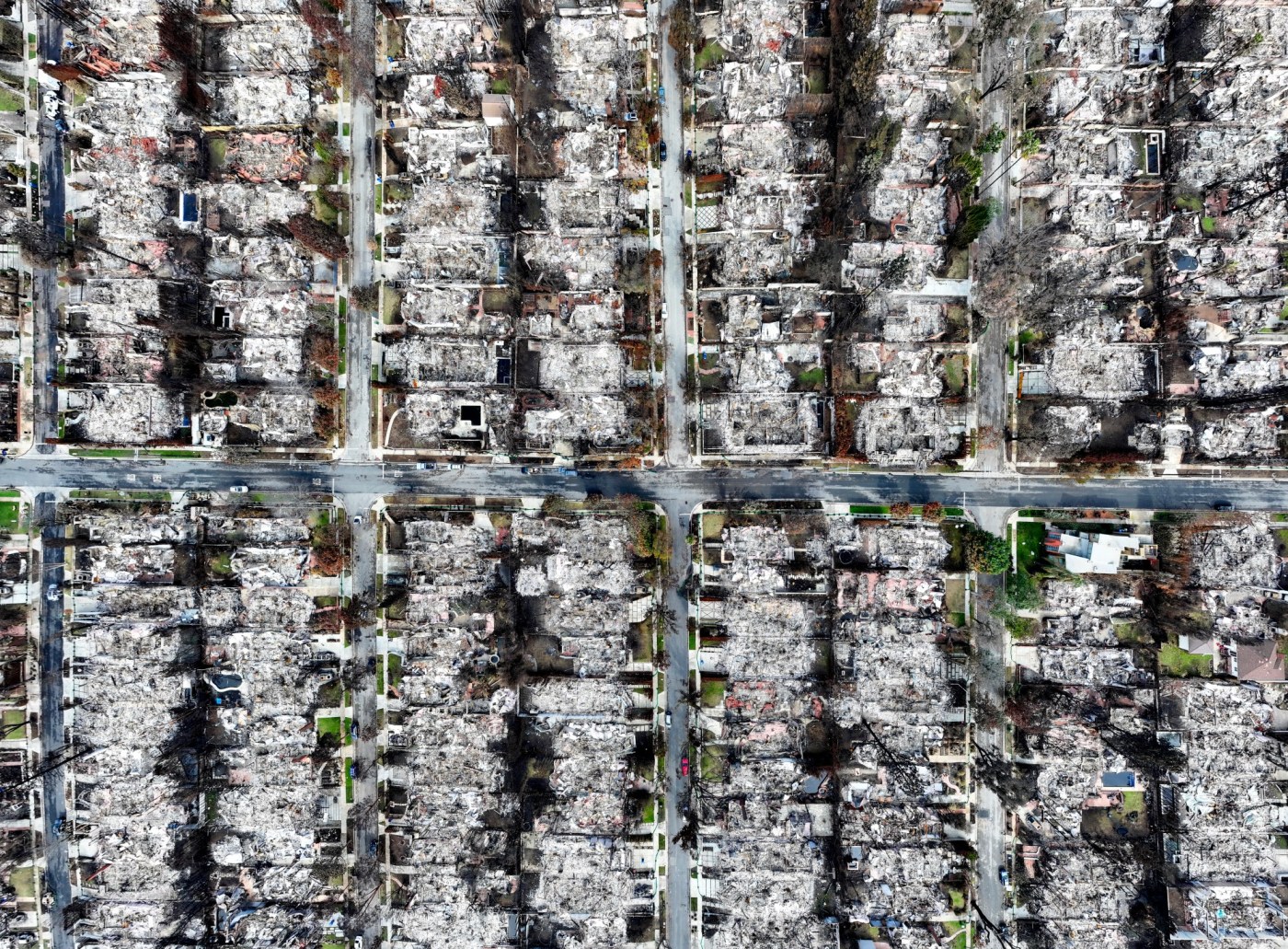

The Eaton fire and Palisades fire killed 30 people and destroyed 16,000 structures, causing as much as $131 billion in economic losses.

Under Newsom’s plan, the fund’s new sunset date would be 2045 instead of 2035, said the people familiar with the discussion. The legislation would also require state agencies to conduct a study examining how to spread the cost of utilities’ wildfire risks across a broad swath of California taxpayers.

Newsom is also pushing to cap the amount insurers can obtain from the fund through subrogation claims, which give them the right to compensation from a utility found liable for fire damage, the people said. Newsom’s office believes that power providers are being overly generous in settling such claims, which are often purchased by hedge funds that intend to seek bigger payouts from utilities, one of the people said.

The legislation under discussion may be met with opposition. Utility executives have called for replenishing the fund to fall on California ratepayers, not company shareholders. Insurers may also contend that capping the amount of money they can obtain from the fund through subrogation claims will force them to raise rates or limit policies in the state, which has already seen an exodus of private coverage in wildfire zones.

The governor’s office believes that utilities are contributing to the rapid depletion of the wildfire fund by agreeing to overly high settlements of subrogation claims, one of the people said. Newsom’s office believes settlements should be around 40 cents on the dollar, but they currently can top 50 cents, the person said.

Last month the California Earthquake Authority, which administers the wildfire fund, described the rising transactions around subrogation claims as “opportunistic, profit-driven speculation.”

It’s unclear when Newsom’s legislative proposal would be introduced by a lawmaker in the state legislature. The legislature reconvenes from summer recess on Aug. 18.

More stories like this are available on bloomberg.com

©2025 Bloomberg L.P.