U.S. home sales fell by the biggest amount in a year in May as an extended buying slump continues.

My trusty spreadsheet reviewed nationwide transaction data from Attom, finding 341,477 closed sales of houses and condos, both existing properties and new construction. That’s an 11% decrease over the past year.

RELATED: Millionaire renters surge across Bay Area, study finds

Homebuying has stalled as prices and mortgage rates remain elevated, and economic uncertainty persists.

Related Articles

Top 10 home deals in Alameda, Piedmont and Oakland the week of June 23

Which 10 San Jose homes had the best prices the week of June 23?

Fremont: What were the 10 best deals for homes sold the week of June 23?

In the week of June 23 top 10 list: Best home deals in Oakland

US home sales fade in June as prices soar to record levels

How lethargic is this market? Sales are 15% below the 399,972 average for May since 2005. This May was the sixth-slowest such month in 21 years.

Consider a slightly longer-term view to appreciate this long-standing stagnation.

There were 3.94 million residences sold in the 12 months ending in May 2025. That’s 10% below the average pace over the past two decades.

No. 1 price

Those who are buying are paying up.

The nation’s $367,000 median selling price for May is an all-time high, surpassing the previous peak of $365,000 in June 2024.

But pricing is under pressure. Appreciation averaged 7.4% a year during the last six years. However, the median is up only 2% in the past year.

May was the second-worst 12-month performance for home prices in the past 24 months.

Payment pain

Most of the nation’s house hunters have balked at the lofty prices and elevated mortgage rates.

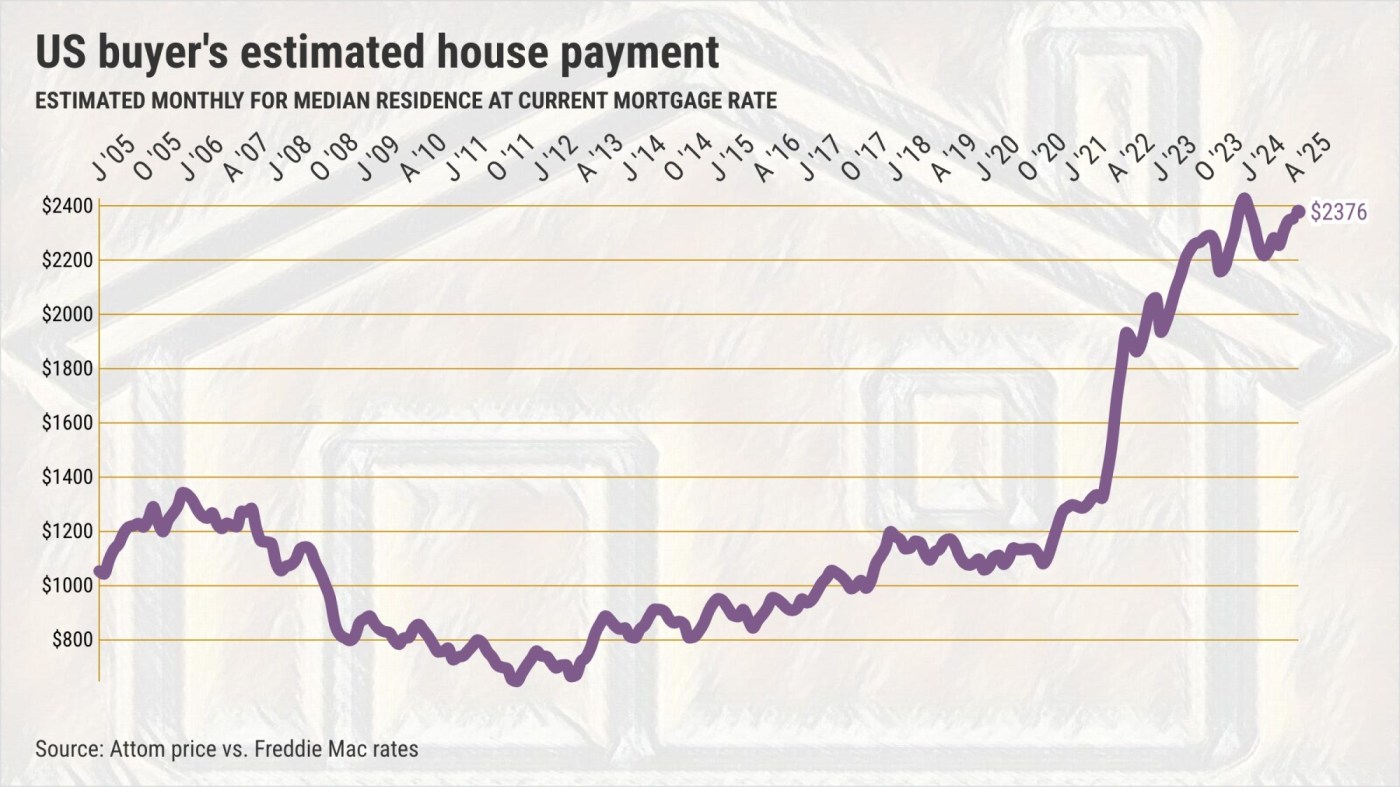

Borrowers got an average 6.8% 30-year rate in the three months ending in May compared with 7.1% in May 2024.

However, rates remain above the 4.1% rates of six years ago, before the pandemic altered the real estate market, or the average 4.8% since 2005. And don’t forget the rate troughs of the past two decades: 2.7% in January 2021 and 3.4% in December 2012.

So, a typical May buyer for the nation’s median-priced home has an estimated house payment of $2,397 – the third-highest on record – assuming a 20% down payment at the average mortgage rate.

Yes, while the house payment is off 0.5% over 12 months, the buyer’s burden is 108% higher in six years.

And another expense trips up wannabe owners: the down payment. In this example, it’s $73,400.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]