Will lower mortgage rates convince California house hunters to stop balking at unaffordable homes on the market?

What’s next for interest rates is a heated, national debate.

Related Articles

Marin median house price climbs to $1.9 million

California’s former insurance commissioner wants oil and gas companies to pay for the home insurance crisis

Contra Costa County reports 26% drop in homelessness

California home prices dip 1% in May, 1st drop in nearly 2 years

Judges clear way for Berkeley to close two of its largest homeless camps

The Federal Reserve is taking a cautious approach to further cuts in the rates it controls, fearing ongoing trade wars could reignite problematic inflation. Fed critics, most notably President Donald Trump, think rates are too high and the Fed should be aggressively cutting.

Political theater aside, what might lower rates mean for California’s housing market? And remember, Fed cuts don’t always lower what mortgage borrowers pay.

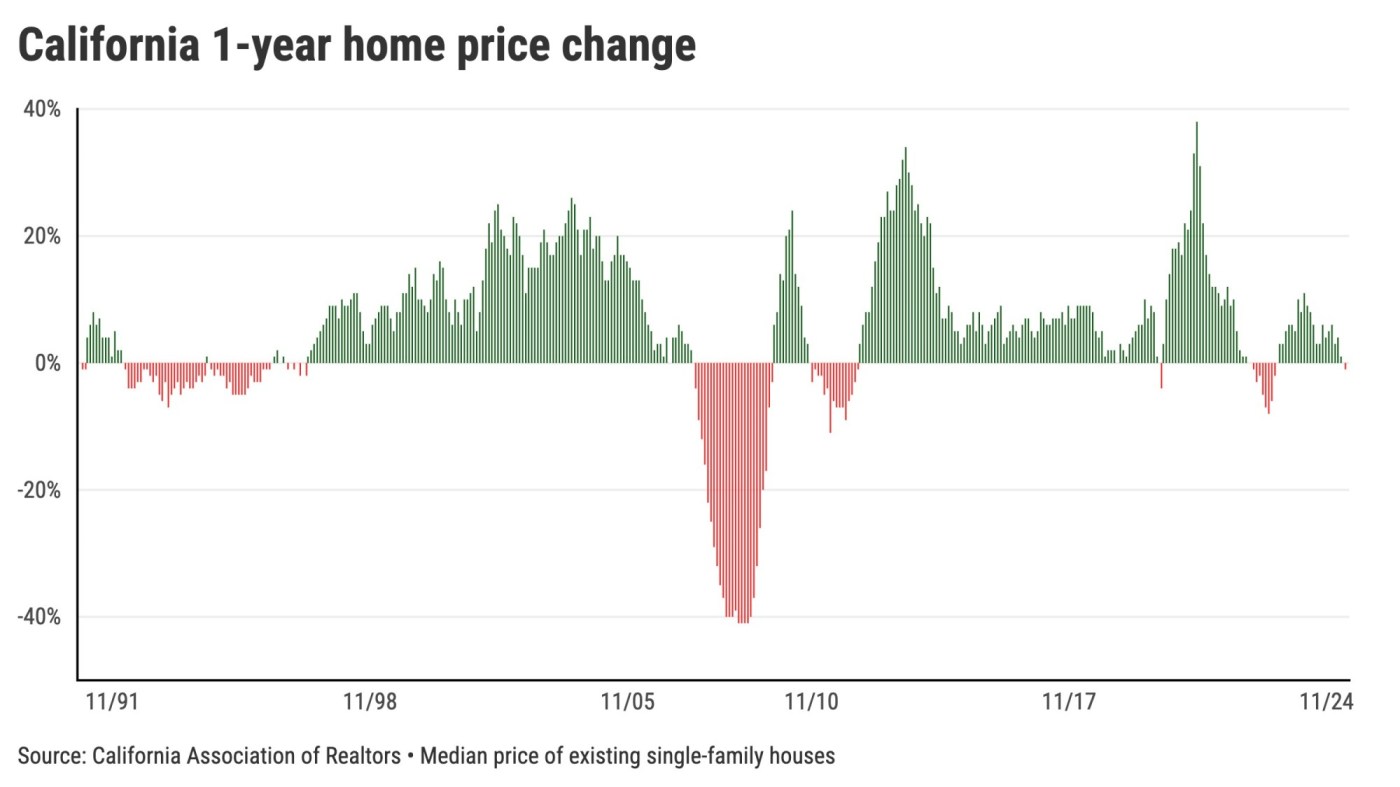

Let me remind you, and not for the first time, that a historical perspective suggests that cheaper money is not a perfect cure. You see, bargain financing has a bad habit of arriving when the economy is in disarray.

To see what’s up – or down – with the market, my trusty spreadsheet looked at statewide homebuying data from the California Association of Realtors, the average 30-year mortgage rate from Freddie Mac, and government job statistics.

These economic indicators were divided into three groups dating back to 1990 to gives us a view into how homebuying performed in 12-month periods – when rates fell the most vs. when financing costs increased significantly.

During these 36 years, rates averaged a drop to 5.5% from 6.5% in their gaudiest declines. Within the largest significant rate increases, mortgages averaged a jump to 6.2% from 5.2%.

Rate changes

When rates drop, house hunters get busy.

The number of single-family homes sold averaged a 5% one-year gain during the biggest rate cuts since 1990. However, sales decreased by an average of 6% when rates rose sharply.

But there’s a catch: Sales declined in 34% of these 12-month periods when rates tumbled.

And look out for cooler appreciation.

The statewide median home price rose an average of 4% in the years when rates tumbled since 1990, but it increased at a 7% annual pace when rates jumped.

Plus, prices dipped 20% of the time when rates fell sharply.

Cheaper money can also alter the number of options house hunters have to choose from.

Inventory, as measured by days on market, fell by an average of 11% when rates tumbled in 36 years, but rose 12% with rate jumps. Elevated buying may have gobbled up supply.

And buyers’ timing can change.

Days on market sped up by four days on average with declining rates since 1990, but selling times increased by four days when rates jumped.

Affordability matters. Estimated house payments fell 5% on average with declining rates but increased by 18% when rates rose.

Tricky juggle

Do not forget real estate’s three keys: “Jobs. Jobs. Jobs.”

When mortgage rates took their deepest dives during the past 36 years, the number of California workers fell by 0.4% on average, as California unemployment rose to 8.2% from 6.8%.

Buying a California home requires a solid paycheck.

Consider how employers statewide hired when rates soared since 1990. Jobs grew at a rate of 2.4% annually, as unemployment dropped to 5.8% from 6.5%. Those extra paychecks create potential house buyers.

So it’s a tricky juggle between real estate’s thirst for cheaper money and its need for a healthy job market.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]