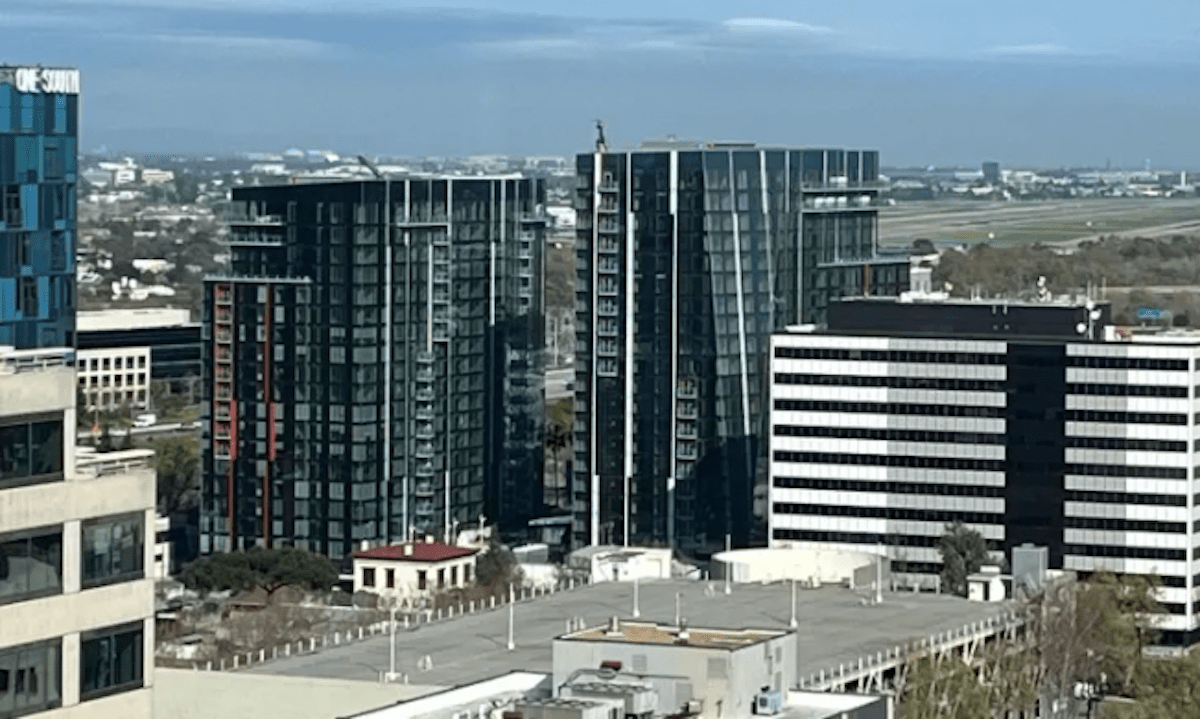

SAN JOSE — Two housing towers in downtown San Jose have been bought through a fast-track foreclosure proceeding that points to a hefty drop in the value of the landmark high-rises.

Machine Investment Group, acting through an affiliate, took ownership of the 188 West St. James residential towers through a deed in lieu of foreclosure, according to documents filed on June 3 at the Santa Clara County Recorder’s Office.

Related Articles

El Camino Hospital buys South Bay site from ag company Yuki Farms

Tech company widens South Bay buying binge with new property deal

San Jose hotel goes up for sale in tough Bay Area lodging market

Historic Hayes Mansion in San Jose carves out a hotel niche as it adapts to changing times

Old San Jose store site’s makeover into tech campus gets key city OK

The real estate firm paid $181.9 million for the housing high-rises, an amount that exactly matched the unpaid debt for the property, the county real estate records show.

New York City-based Machine Investment Group’s purchase creates some hope of a turnaround for the troubled housing development at 188 West St. James St. in the vicinity of lively San Pedro Square.

Machine Investment aims to quickly orchestrate a rebound for the double-tower complex, which consists of more than 600 residential units. Each tower has about 300 condominiums, of which some are rentals and some are owned.

China-based Z&L Properties, acting through an affiliate, had been the owner and developer of the two towers. The deal with Machine Investment Group marks a major milestone in the unraveling of the Z&L real estate empire in downtown San Jose.

The Z&L affiliate lost its ownership of the two towers when a $330 million loan that an affiliate of Mack Real Estate Credit Strategies provided in 2019 to finance the property was transferred to Machine Investment Group’s affiliate on June 3.

Immediately after that transaction, on the same day, Machine Investment Group took ownership of the two towers by through a deed in lieu of foreclosure.

Machine Investment also obtained a $215 million loan from an affiliate of New York City-based Benefit Street Partners to help Machine finance its purchase of the towers.

The $181.9 million that Machine Investment’s affiliate paid through the foreclosure proceeding was 44.9% below the $330 million loan that went into default and eventually led to the streamlined foreclosure.

This differential suggests the value of the two towers has nosedived in recent years.

Slumping property values extend well beyond its effects on real estate. Property value trends can imperil revenue for an array of public agencies.

If real estate values turn soft in a region, the decline could squeeze a crucial revenue stream for cities, counties, regional agencies and school districts.

The transaction also ends a long-running ordeal for the West St. James towers that has stretched over about eight years.

During the Z&L affiliate’s ownership, a loan delinquency, foreclosure threats, lawsuits, project delays, construction blunders and defects, evidence that some workers were forced to live in an East Bay warehouse, allegations of slave labor, intrusions by homeless people into the property’s hallways, and a death have haunted the property.

The new owner has wide-ranging plans for improvements, according to Eric Rosenthal, managing partner for Machine Investment Group.

“Our firm is uniquely positioned to apply its construction, finance and development expertise to stabilize building operations, relaunch sales, and provide an important housing solution to one of the most dynamic residential markets in the country,” Rosenthal said.

Machine Investment Group intends to recapitalize the project, prepare units for sale, and re-engage with the community to restore confidence in the towers. The real estate firm intends to sell the remaining condos.

“A fresh start for 188 West St. James” is the primary goal for the towers, Rosenthal said.