The proprietor of a San Rafael lending business is seeking bankruptcy protection, leaving local investors worried about major losses.

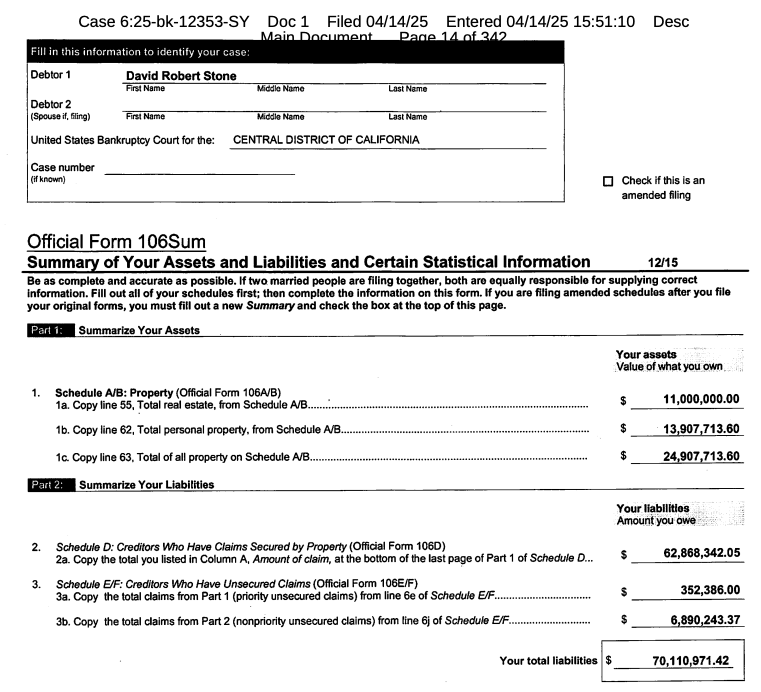

David Robert Stone, who runs Cornerstone Financial Services, reported more than $70 million in liabilities and about $24.9 million in assets.

Many of his creditors are Marin County residents.

Related Articles

Credit union eyes HQ and branch campus with San Jose property purchase

Credit union buys long-empty San Jose site of popular restaurant

Charles Schwab accused of firing Los Altos investment consultant because he ran for Congress as Democrat

SpaceX cybersecurity engineer tapped for Fannie Mae board amid shakeup

Jury deadlocks over Umpqua Bank’s alleged complicity in a $250 million scam

“The investors are going to take a huge haircut on this,” said Robert Vogl, a retired business executive who lives in Fairfax. “We’re going to get pennies on the dollar.”

Stone’s lawyer submitted the Chapter 7 bankruptcy filing on April 14 in U.S. District Court in Riverside. Neither Stone nor the lawyer, Michael Spector of Santa Ana, responded to messages seeking comment.

A group of Cornerstone investors met over the weekend to assess their situation.

“Most of these people who have invested are in their 70s and 80s,” Vogl said. “In a number of cases, it completely wiped them out.”

Vogl, who invested $450,000, is one of about 60 “secured” creditors, 20 of whom are Marin residents. According to the bankruptcy filing, the secured creditors’ claims alone total more than $62.8 million. Most of these claims are secured by only about $12.6 million in loans owed to Cornerstone.

Cornerstone’s website says, “Our speciality is financing semi-truck tractors and trailers from mid-size to long haul, both new and used.”

Jason Solomon, a former investor who says he got to know Stone well, said, “If you were a truck driver who was hard up on your luck and you wanted to buy a truck, Stone would loan you money at a 30%-plus interest rate. Then he would pay all of us a 10% return on our investment.”

Vogl said the loans might have been structured as lease-purchase agreements. Cornerstone’s website states that it “operates as a fixed lease provider for the independent owner/operator semi-truck industry.”

“We’re trying to figure out exactly what the business model was,” Vogl said.

Cornerstone’s website states: “Stop losing valuable money in the stock market. Find out how to earn a 12% fixed rate of return.”

The website goes on to say that investments are “secured by dedicated hard titled assets. This business model has withstood the multitude of economic uncertainties presented over three decades. To date, not one single investor has suffered a principal dollar loss.”

The website also promotes an option “to invest retirement funds through our self-directed IRA facilitator, Pacific Premier Trust.”

Eight of the secured creditors invested through Pacific Premier Trust, according to the bankruptcy filing. The money owed to them exceeds $5.1 million.

Vogl said he started investing with Cornerstone last year “the same way most other people did, through friends who had been invested with him for decades.”

“The guy had been in business for 40-plus years and never missed an interest payment to any investor,” Vogl said. “He represented to a number of investors when they would get together for social events that he had no debt, didn’t believe in having debt.”

Vogl said that, unlike him, many of the investors know Stone well.

“They go back 20, 30, 40 years with him, essentially his closest layer of friends,” he said. “He goes out to dinner with him, plays golf with him. They grew up together, go on vacations together.”

Solomon said he has known Stone for 25 years.

“We would go boating and traveling to Cabo San Lucas and Hawaii,” Solomon said. “He was a high roller. He would walk around with $50,000 in cash in his pocket all the time.”

Solomon said he had $2 million invested with Stone at one point.

“I got out in 2023,” he said. “Unfortunately, my ex-wife had half a million with him, and that is gone.”

Among the personal possessions Stone reported in the bankruptcy filing are a $5 million house in Palm Desert; a $4 million house in San Rafael; a $2 million condo in San Rafael; a leased Bentley; an armored Ford F-550 truck valued at $150,000; a $30,000 membership in the Meadow Club, the members-only golf course in Fairfax; 210 bottles of wine valued at $7,000; and some 25 long guns, assorted hand guns and 90,000 rounds of ammunition valued at $27,000.

“For years, we thought of him as kind of a doomsday prepper,” Solomon said, “because every time we would go somewhere, he’d go to the gun shops and buy hundreds of thousands of rounds of ammunition and guns, and stash them at warehouses in Arizona and Nevada.”

Blake Andros, who operates auto repair businesses in San Rafael and Novato, knows Stone well, but he declined to comment. Andros, among the many unsecured creditors listed in the bankruptcy filing, is owed $5 million. His wife, Linda Bruggenkamp, who is listed among the secured creditors, is owed more than $2.4 million.

Ultimately, the distinction between secured and unsecured creditors might prove inconsequential. Vogl said it appears that Stone failed to take the necessary legal steps to “perfect” some or all of the secured creditors. The perfection process establishes the secured creditor’s priority over other creditors in the case of a bankruptcy.

The county and federal court websites show no active lawsuits against Cornerstone Financial Services or Stone. Vogl said some creditors have contacted the Marin County District Attorney’s Office.

“If we were conducting an investigation we couldn’t disclose the status at this time or make any statements,” District Attorney Lori Frugoli said.